Shaky Economics and the Poor

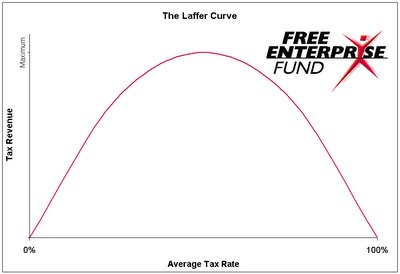

Supply Side Bulge

Supply Side BulgeI know some of you hated economics in college, so please forgive the graph. But read on. Trust me, it's relevant. And even if your palms get clammy at the sight of the Laffer Curve above you'll find the post below easy to follow.

Wanted to return to the issue of the morality of the federal budget and how it affects poor people. You can check out "Moral Budgets" (November 05) for the first part of the discussion.

What Shook Out

Congress will ratify the new federal budget as soon as tomorrow.

It's not as bad as it could have been, mostly due to the opposition of justice activists and a few key players in both political parties. Dr. John Perkins, the seemingly ageless founder of Harambee Christian Family Center and the Christian Community Development Association, was among those arrested a few weeks ago in D.C. protesting the proposed budget.

Things have sure changed these days at Harambee.

But the new budget will still be pretty harsh.

The quick summary: dramatic cuts in a whole variety of bedrock programs for the poor and extended tax breaks and benefits for the "investment" class (i.e, the well off :^). Not to mention lots of big ticket pork barrel projects and big scratch for the wars we're now fighting against tribal enemies who might someday threaten us with the nuclear weapons that we originally developed

The Congressional Budget Office just released a study that showed the specific effects of the new budget on health care for the poor: "...millions of low-income people would have to pay more for health care under the bill worked out by Congress, and some of them would forego care or drop out of Medicaid because of the higher co-payments and premiums."

Real world translation: A whole lot of the poorest people are likely to go without medical care because of the new budget. And that's just one of the many negative effects for the poor.

The Magic of Supply Side Economics

Why would moral and thoughtful people who genuinely want to help the poor pass a budget like that? I believe some of the folks who voted for it fit that description.

The simplest answer? They genuinely believe that cutting even effective programs for the poor and giving tax cuts to wealthy people help the poor by creating economic growth and more jobs for everybody. They also think cutting aid to the poor gives them incentive to get out and work, thus benefiting poor people morally and adding to the economic growth that helps everybody. Finally, they believe that by cutting taxes on the investment class overall tax revenues will increase as economic growth expands. In effect, the tax cuts for the rich will "pay for themselves."

The ideology driving the congressional majority and our executive branch is a version of supply-side economics. Many supply siders unfortunately appear to be true believers. One of the economics editors of The Economist recently described the Bush White House as "an administration that truly believes that tax cuts for the wealthy and benefits cuts for the poor will solve almost any problem."

I guess I'd like to ask at least one key question in evaluating supply-side federal budgets like the one Congress will ratify tomorrow.

Is there clear and obvious evidence that giving further tax breaks to the wealthy and cutting benefits to the poor enhances overall economic performance and creates more jobs and overall wages for the poor?

Clearly, no moral person would support a budget that cuts beneficial programs for poor people unless they were very sure those cuts would bring substantial benefits that would outweigh the suffering caused by the cuts.

What About the Evidence?

That same edition of The Economist contained a fascinating article which carefully looked at the economic data from the past 5 years in the US.

They concluded that there is little if any evidence that the Bush tax cuts for the wealthy generated substantially greater economic activity or more jobs or wages for the poor.

Further, they challenged the idea that supply side tax cuts for the wealthy will "pay for themselves" through increased economic activity. That's important because supply siders make that pitch in selling tax cuts for the rich and benefits cuts for the poor.

The fact is the hard evidence simply won't support such a claim.

Remember, The Economist isn't MoveOn.org. It's arguably the world's leading market oriented publication.

The historical record of the US economy during the last 50 years and basic comparisons with other world economies also cast some doubt on supply side claims.

It's true that punitively high tax rates on the investment class and unrealistically generous welfare programs for the poor and other groups in a society can slow economic growth and therefore can inadvertentely hurt a lot of people.

But, of course, that's not the situation we're dealing with in the US right now. As I've mentioned before, our tax rates on the well off are among the lowest in the developed world and our social benefits for the poor are among the least generous.

When you look back on the track record of the US economy, it's fairly obvious that the economy flourished at times when income and investment taxes on the wealthy were signficantly higher and useful social programs for the poor were more generous than they are now.

Very strong economies in the 60's and 90's boomed in the midst of non-supply side tax codes and budgets. Whatever you might think of Bill Clinton's personal morality, more wealth was generated during his years in office and more people rose out of poverty than at any time in recent memory.

The economic situation of the poor in America has declined by pretty much every measure during the Bush years just as they did during the supply side Reagan years.

So I'd argue the evidence is tenuous at best that cutting benefits for the poor and taxes for the wealthy actually helps the poor.

Getting Out Ahead of the Curve

Why is all that important? Well, for those of us who are less ideologically oriented and who are interested in the plight of the poor, I think we've got to evaluate who we're supporting and how we're voting. And I believe that's true no matter what our political orientation might be.

And for those of you who are passionate supporters of supply side thinking--particularly if you're trying to advocate for the poor--maybe a little less passion and a little more honesty would be in order.

Advocating for approaches that cause real suffering for poor families without clearly creating benefits that outweigh that suffering might turn out to be pretty counterproductive.